In October last year, former Minister Van Gennip submitted the legislative proposal ‘Assessment of Employment Relationships and Legal Presumption (Clarification) Act' (VBAR) for internet consultation. The content has received significant criticism, particularly from freelancers, employers, and freelancer organizations. The Advisory Board on Regulatory Burden (ATR) was also critical. Consequently, the draft law has been further adjusted.

Under Dutch law an employment agreement is defined as an agreement under which one of the parties (the employee) obliges him- or herself towards the other party (the employer) to perform work for a certain period of time. This work is performed in service of the other party and in exchange for payment (article 7:610 Dutch Civil Code). Especially the following conditions are relevant for the qualification of an employment agreement:

Once it has been determined what parties agreed upon in terms of rights and obligations (the explanation phase), it must be assessed if these rights and obligations meet the definition of an employment agreement (the qualification phase).

Most qualification discussions relate to the question whether there is authority, as this element distinguishes the employment contract from other agreements pursuant to which work is performed.

The VBAR clarifies the element of authority and includes that authority exists if:

The work is performed under work-related or organizational instructions of the work provider/client, and;

The worker does not perform the work for his or her own account and risk or the work is performed to a lower extent for his or her own account and risk compared to said instructions.

In an earlier version of the legislative proposal, the element of the work or worker being ‘organizational embedding in the employer’s organization’ was explicitly mentioned. In the revised legislative proposal, this element is removed, and two main elements are introduced. The ‘work-related or organizational instructions’ (main element W) is initially compared to the element ‘own account and risk’ (main element Z). For assessing whether there is an authority relationship, it is relevant which element prevails.

The following indications apply for the interpretation of the mentioned main elements:

W. Work-related or organizational instructions

Z. Working for Own Account and Risk

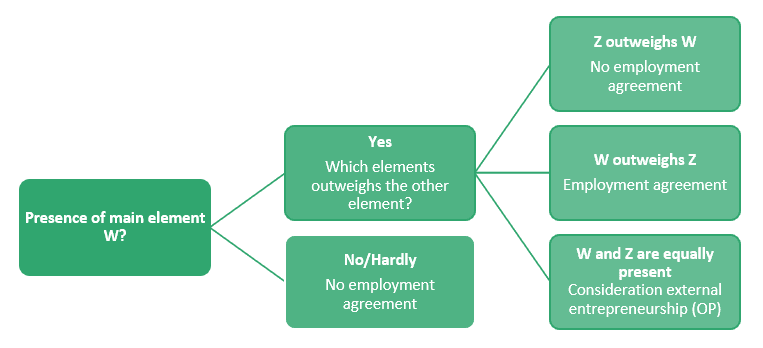

When determining if there is authority, one must first look at the main element W (work-related or organizational instructions). If there are no indications of substantive or organizational direction, there can be no ‘in service of’ and thus no employment contract. Further assessment will not be required.

If there are indications of the presence of substantive or organizational direction (main element W), these indications will be compared with the contra-indications of ‘working for own account and risk’ (main element Z). Both main elements can potentially weigh equally. If the emphasis is on main element W, there will be an employment contract. If this is the other way around, there will be no employment contract.

Only if the indications for main element W are present to a similar degree as the indications pointing to the presence of main element Z, the entrepreneurship of the concerned worker outside the employment relationship for similar tasks is considered (OP). Examples (non-exhaustive) include:

OP. Characteristics Indicative of Entrepreneurship of the Worker (Outside Employment Relationship) for Similar Tasks

This legislative proposal also includes the introduction of a legal presumption. Based on this presumption an employment agreement will be deemed to exist if the hourly remuneration for the work does not exceed € 33. In such case the employer/work provider must prove that there is no employment agreement.

The legislative proposal has been submitted for advice to the Council of State. Subsequently, the legislative proposal will be further discussed in the Dutch parliament and possibly amended in some parts. It is expected that this legislation will enter into force as per 1 January 2026.

Do you have questions about this legislative proposal? Get in touch with Jaouad Seghrouchni, Senior Associate, Attorney at law, Employment Law & Employee Participation.

Would you like an overview of updates and blogs in your inbox? Click here to subscribe to the newsletter!